WELCOME TO TRADERS SAATHI

Discover the Best CIBIL SCORE of your Client

Looking for the perfect CIBIL SCORE can be time-consuming

and overwhelming, which is why our credit card CIBIL SCORE marketplace is here to help all online traders.

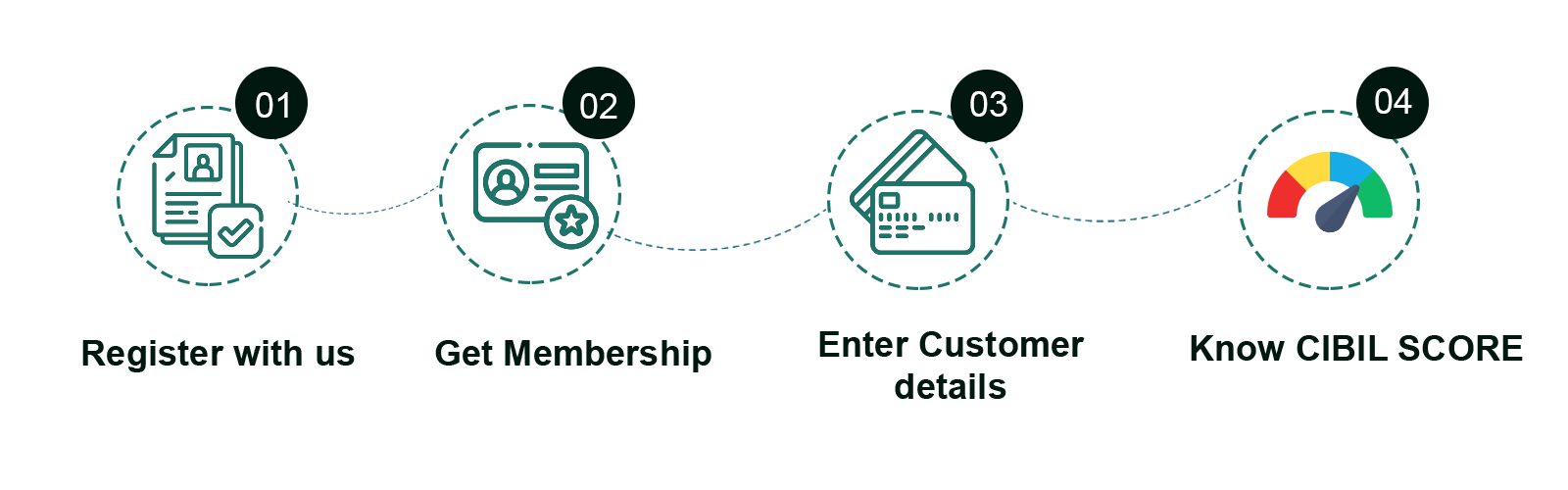

Register with us and get to know the CIBIL SCORE of your customer.